Best investment apps to quadruple your income in Nigeria

Gone are the days when investing was the exclusive domain of the wealthy elite, confined to stuffy boardrooms and impenetrable jargon.

Today, thanks to a surge of innovative investment apps, investing is becoming accessible to everyone, ensuring wealth creation and empowering individuals to take control of their financial futures.

We have a handful of commendable apps that are bolstering investment in Nigeria. From micro-investing platforms that let you start with as little as ₦1,000 to sophisticated tools that cater to seasoned investors, these apps are making investing more inclusive than ever before. Some of the best investment apps in Nigeria include:

Cowrywise

Cowrywise is a popular investment app offering a diverse range of investment options, including stocks, mutual funds, ETFs, automated savings plans, and fixed-income securities. Regulated by the Securities and Exchange Commission (SEC), Cowrywise is seamlessly accessible to both beginners and experienced investors with its user-friendly interface and educational resources.

With Cowrywise, users can initiate automated savings starting as low as ₦1,000 per day, week, or month through the Periodic Savings Plan. Interest rates vary from 3 months – 5.50% p.a, 6 months – 6.50% p.a, 9 months – 7.50% p.a and above 1 year – 8.50% p.a.

The app allows for one-time deposits with spare change and offers stronger interest rates compared to traditional banks. Users can save collectively in Circles to achieve goals faster and create a personalised Emergency Fund for unforeseen emergencies.

Cowrywise facilitates investment in mutual funds aligned with financial goals and risk appetite. Professional advisors assist users in developing personalised investment plans, and diversification is achieved by investing in mutual funds from top Nigerian investment firms.

The app easily integrates with Stash, enabling users to receive dividends and top up their Cowrywise savings and investment accounts.

Cowrywise prioritises security by holding savings in low-risk financial instruments through SEC-registered Meristem Trustees Limited. The app ensures customer data safety by not storing card information, using a PCI-DSS-compliant payment processor.

Cowrywise provides 24/7 support through various channels, including the app, phone, email, Facebook, Instagram, and X. Whether for set-up assistance or discussing investment plans, support is readily available.

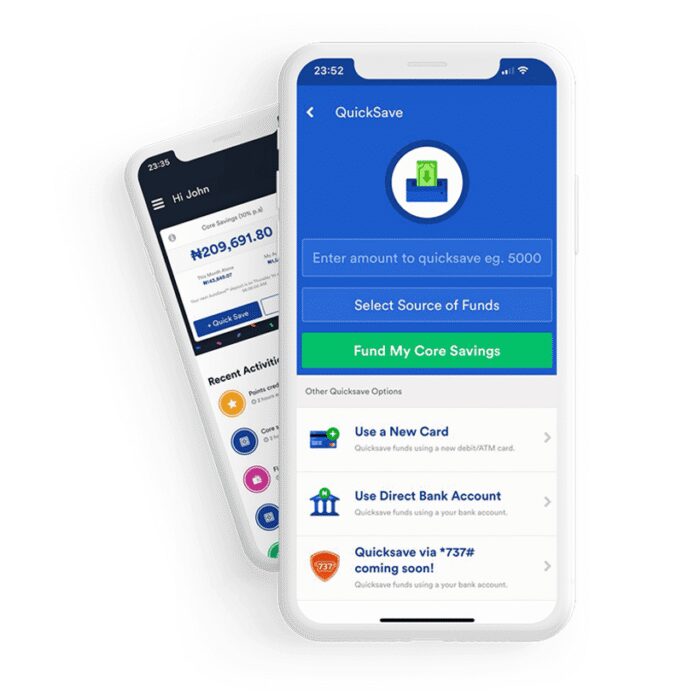

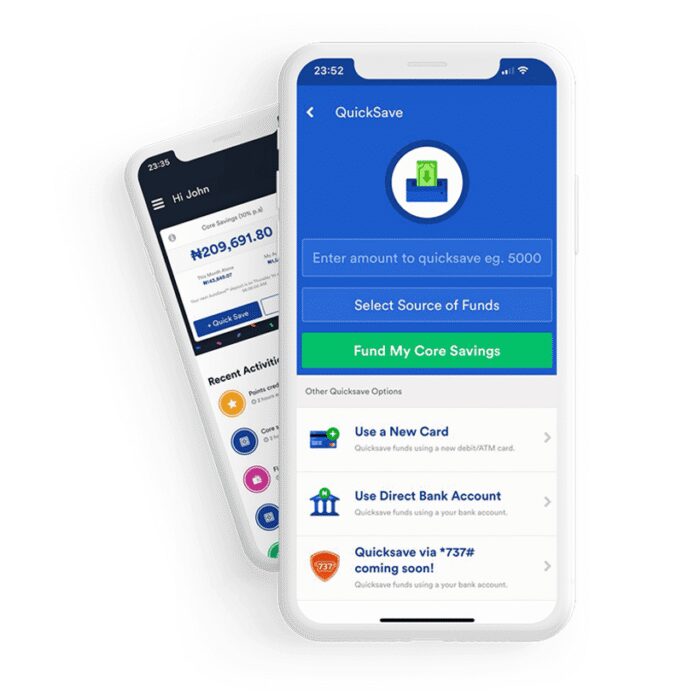

Piggyvest

Piggyvest is known for its savings features, offering users the ability to set savings goals and track their progress. Additionally, Piggyvest provides various investment options, including savings plans, targets, and lump sum investments.

Piggyvest’s Investify enables users to access pre-vetted investment opportunities in commercial papers, real estate, agriculture, transportation, and fixed-income assets with a minimum investment of ₦5,000, with interest rates varying between 7% to 25% Users can even resell at a higher price after purchase, when units are sold out.

The app emphasizes security, with over a trillion Naira saved and invested over the past 7 years, SEC regulation, NDPR compliance, and high-level internet and bank security.

Piggyvest ensures transparency by providing monthly interest alerts and offers a responsive and intuitive customer support system. A self-help service in the app assists users with specific issues.

Bamboo

Bamboo is a micro-investing app facilitating investment in fractional shares of stocks, making it ideal for beginners looking to start investing with a small amount of money.

Bamboo simplifies the entry into investing, requiring only the National Identification Number (NIN) and contact details for registration. The process is entirely paperless, allowing users to start trading from their mobile phones.

The app ensures instant trading, allowing users to invest in companies they believe in and providing the flexibility to liquidate positions. With 8% interest rate, Bamboo protects trades and positions with insurance from the Securities Investor Protection Corporation (SIPC) and the Financial Industry Regulatory Authority (FINRA) up to $500,000.

Bamboo breaks down barriers for non-U.S. citizens, offering access to over 3,000 stocks with a market capitalization exceeding 21 trillion USD. Users can start investing with as little as ₦15,000 and own fractions of shares in various companies.

With the vast opportunities in the U.S. stock market, Bamboo enables users to potentially make a fortune through buying and selling a variety of stocks.

Trove

Trove is a micro-investing app that provides access to a range of investment options, including stocks, mutual funds, and ETFs. The app offers a user-friendly interface and educational resources for investors.

Trove has built innovative features, including Virtual Mastercards for spending and bill payments. The Trove Vault allows users to manage funds between portfolios, cards, or transfer to family and friends. The Trove Learning Portal, in partnership with a leading financial education provider, offers insights into investing and personal finance.

Trove ensures a user-friendly experience with intuitive tools and information. The app provides live quotes and charts for over 10,000 financial instruments, including stocks, bonds, and commodities. Advanced tools, such as Technical Summary and Market Quotes, enhance the investing experience.

Serious about security, Trove encrypts personal information and securely stores it. The app employs 256-bit encryption protocols and cutting-edge security technologies, providing users with confidence in the safety of their assets.

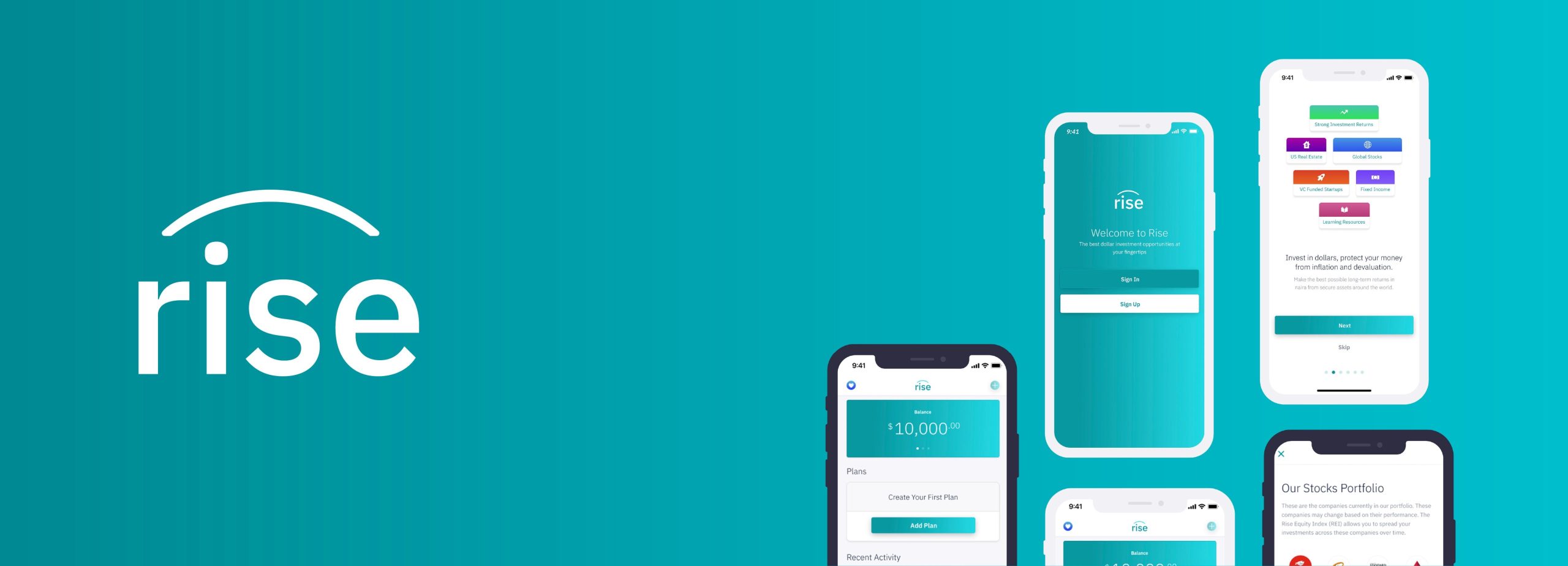

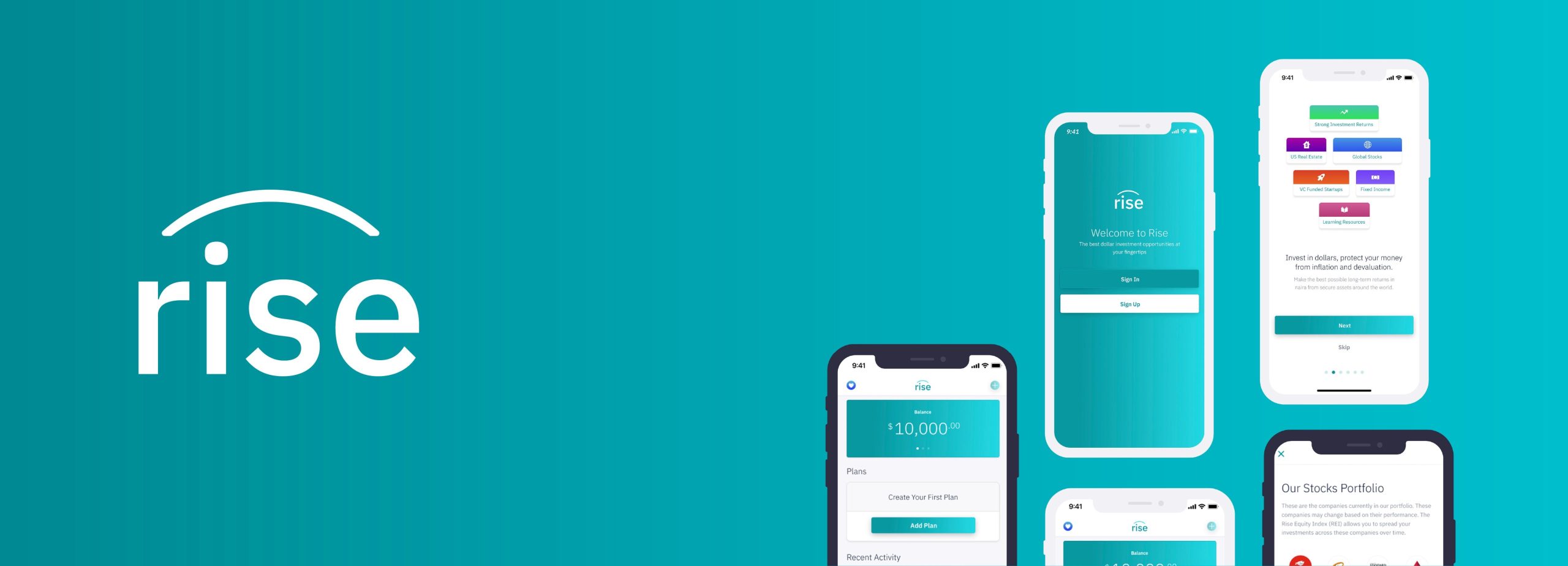

Risevest

Risevest is an investment app offering diverse portfolios tailored to different risk tolerances, making it an excellent choice for hands-off investors.

With interest rate varying from 10%, 14% to 15% Risevest assists users in building wealth by connecting them to U.S. investments earning returns in dollars. The app provides access to expert financial advice through in-app chat or scheduled sessions, instilling confidence in investment decisions.

Risevest focuses on world-class wealth management, ensuring that assets on the platform are among the highest quality. The app offers portfolios with varying risk levels and attractive annual returns across stocks, real estate, and fixed income.

Risevest caters to different investment preferences, allowing users to invest in expertly selected U.S. stocks, high-demand commercial real estate properties, and low-risk fixed-income assets. Returns on investment with Risevest are based on historical data and not guaranteed.

I-Invest

I-Invest is an all-in-one financial marketplace providing access to various investment products, including Treasury bills, fixed deposits, commercial papers, equities, and more, with interest rates varying from 8% to 11%.

I-Invest offers a range of investment products, from Treasury bills to equities, all within a single platform. Users can track portfolio performance and conduct wallet transactions conveniently. The app provides real-time access to investment performance.

I-Invest ensures regulatory compliance and security with competitive rates, regulated products, and bank-level security measures. Investors can enjoy the benefits of diverse investment options within a secure environment.

The app promotes community engagement by allowing startups to raise funds from their communities, fostering ownership and loyalty.

Pillow Fund

Pillow Fund is an investment app offering both crypto and traditional investment portfolios tailored to different financial goals.

Users earn daily interest at a competitive rate, credited daily, with a minimum investment of ₦1,000. Pillow Fund provides an opportunity to invest in USD-backed cryptocurrencies like Bitcoin and Ethereum. Interest rate is 14% per annum.

The app enhances security through BitGo, offering $250 million custody insurance for an additional layer of financial security. Users can enjoy the flexibility of instant withdrawal, making it convenient to access funds.

Earnings on Pillow Fund are based on daily interest and are not restricted to month or year-end crediting.

Quidax

Quidax is a cryptocurrency exchange that simplifies the process of buying, selling, and trading cryptocurrencies. It allows users to make their money work for them, offering up to 10% interest on savings. The app protects savings from inflation by holding them in USD.

Users can start with as low as ₦5,000, and Quidax ensures instant withdrawal, providing quick access to funds when needed.

Quidax places security at the fore, employing secure cryptocurrency wallets protected with 256-bit encryption protocols and two-factor authentication. The app facilitates instant swaps between local currency and various cryptocurrencies.

Quidax offers 24/7 support, addressing user questions and providing assistance. The app’s user-friendly interface ensures a seamless and easy navigation experience.

GetEquity

GetEquity revolutionises startup funding by enabling fractional investing in early-stage startups.

Users can invest in early-stage startups with fractional shares, gaining instant access to angel investors, syndicates, and institutional investors. Startups also have the opportunity to raise funds from their communities, promoting ownership and community engagement.

Startups can raise funds directly from their communities, building a sense of belonging and loyalty.

Wealth.ng

Wealth.ng is an online investment platform providing access to various investment products, including bonds, Eurobonds, stocks, real estate, and agriculture. Interest rate varies between 6% to 20%

Wealth.ng offers a diverse range of investment products on a single platform, eliminating the need to manage different investments on separate platforms. The app ensures an intuitive and easy-to-use experience, streamlining the investment process.

Security is a priority for Wealth.ng, employing industry-standard measures to protect confidential information and funds. Users can fund their accounts securely using cards or bank accounts, with returns paid directly into their Wealth.ng cash balance.

All investments on Wealth.ng are provided by Sankore Securities, regulated by the Securities and Exchange Commission.